The criteria you should use to decide on which payment methods are best for you are:

1. Markets

2. Type of payment

3. Cost

4. Risk

5. Reconciliation.

6. Other factors

Markets

First of all, markets mean countries. A Payment Processor has market information on most European countries and can advise you what the prevalent payment methods are in a particular country. For example, the UK market is dominated – at least for now – by cards and direct debits. But in The Netherlands, you will need to offer iDeal as well, as this payment method has a dominating position in on-line payments.

Sometimes there is a lot of confusion about payment methods in a particular country. For example, in France, there is a national payment system called Groupement des Cartes Bancaires using the “Carte Bleue” brand. In practice, however, virtually all cards issued in France are co-branded with Visa or MasterCard.

Markets may also mean the socio-economic group you are targeting. For example, if you are targeting a youthful audience, they might not have credit or debit cards, but might have a PayPal account. This is for example the case for merchants who sell digital downloads to mobile phones.

Type of payment

Different payment methods are more or less suitable for different types of payments. All payment types support one-off payments. But what about other requirements?

The main one here is recurring payments. If your business is subscription or renewal based, you will need a reliable and cheap solution for taking these – it is still hard to beat direct debits. However, there is a hardcore of users, estimated at approx. 10% will not use Direct Debits, so you will have to offer at least another alternative.

If you have repeat business from the same customers, and you have web-based customer accounts, your payment methods have to be able to offer one-click payment solutions to make payments as easy as possible to ensure you maximise this repeat business.

Other merchants need an easy and reliable method for returning payments to their customers.

Cost

We will go into much more detail about the cost for cards later. When comparing payment methods, however, the following generalisations can be made:

Although cost is important for everyone, it becomes even more so if the ATV of your product or service is low.

Risk

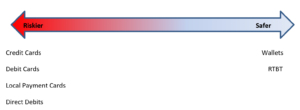

We will be talking about fraud later. But again it is possible to make a general statement as to how much risk is associated with various payment methods.

Note: risk is defined as the chance of non-payment, including chargebacks, etc.

For some companies, risk is more of a factor than others. If you ship physical goods with a high ATV or vouchers you are a bigger target for fraud than if you are dealing with low ATV products or services or products such as insurance. How payments are taken is also important: online payments are riskier compared to call centre payments.

Reconciliation

Esp. larger organisations need to be able to reconcile all payments quickly and easily with a minimum of errors. Process flows need to be in place and ideally, data will be available immediately to logistics/distribution, finance, and customer service operations.

Payment methods and their providers need to be able to provide the information you need. If you increase the number of payment methods you offer, this will also increase the effort required for reconciliation and associated reporting and cost.

Local payment methods often require a local bank account or even a local presence; this again will increase your administrative burden and cost.

You will, therefore, have to balance the part of the payments market you wish to cover versus the complexity and cost of reconciliation.

Other factors

A number of other factors that are important here are:

• Your offer of payment methods needs to be clear, your websites easy to use.

• Where possible you will want single solutions – robust, supportable and upgradeable.

• Solutions need to be compliant with regulation, whether in-house or 3rd party.

• Ease of integration, coupled with focused support from 3rd Parties

• Future proofing to ensure that the mobile and tablet technology can be delivered as integral to core business systems

Why accept cards?

• More convenient for customer and merchant – less cash handling

• Spontaneous sales, increased volume/value

• Displaces cheques – lower handling costs and security

• Speeds throughput at Point of Sale – faster turnover

• Makes sales over internet and phone possible

• Guaranteed funds and security of settlement

• Simpler back-office reconciliation and control; substantially reduces back-office costs