Definitions

Inter-regional Transaction

A transaction where the Issuer of the card used is located in a different Visa/MasterCard Region to that of the Merchant.

Intra-regional Transaction

A transaction where the Issuer of the card used is located in the same Region as that of the Merchant.

Domestic Transaction

A transaction where the Issuer of the card used is located in the same country as the Merchant.

Acquiring license

Acquirer requires a license from card schemes before they may acquire merchants in a certain region

Qualified Rate

Acquirer offers rate based on certain criteria is met. i.e. ecomm trans is 3D Secure/AVS/CVV, CP transaction is authenticated by pin etc. If this criteria is not met an exception charge is applied. Majority of acquiring banks can not check in real time if transaction is qualified.

Interchange Plus

A method of pricing, merchant is charged basic interchange rate of transaction + a set BPS or cent/pence.

Blended Rate

Same rate is offered across multiple card types/regions/channels.

Multicurrency acquisition

Multicurrency Acquisition means the processing and acquisition of transactions in multiple currencies

Pan-European Licence

Acquirer can acquire merchants any country as per card scheme list of countries covered. i.e. UK Acquirer can acquire Non-UK domiciled entity.

Cross-Border Acquiring

If a merchant operates in more than one European country they could have a MSA with one bank that enables them to accept cards in several countries as opposed to having a MSA with a acquirer in each country. Whether or not the merchant can achieve domestic interchange rates in their countries depends on acquiring bank’s platform. In some cases Cross Border Acquiring Restrictions means acquirer can only acquire ‘International Merchants’ (those that operate in a minimum of 3 countries in Europe region.

Introduction

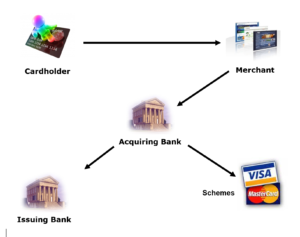

An acquiring bank:

• is a licensed member of MasterCard, Visa, American Express or Diners that screens and accepts Merchants into its bankcard program, processes transactions, and completes financial settlement for them

• acquires transactions performed using a credit/debit card issued by a bank other than itself

• accepts risk for each Merchant that is included in its bank program

• must carefully weigh up the risk against the potential profit for each merchant application

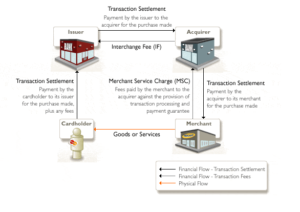

• must pay both the card issuer and the relevant card scheme from any fees charged to the merchant

The bank accepts or acquires credit card payments from card-issuing banks within one or more associations. The best-known (credit) card associations are Visa, MasterCard, American Express, Diners, Japan Credit Bureau, and China UnionPay.

An acquirer supplies a merchant account that allows a merchant to accept credit card payments. From the merchant, account money can be directed to a bank account at the merchant’s bank.

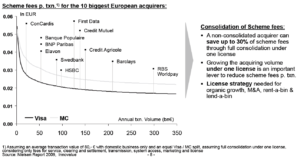

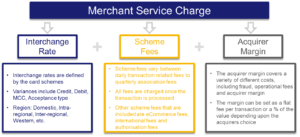

Acquirer pays interchange fees which are fixed rates set by the card associations, and which vary by the type of card used and where the card was issued versus where the merchant is located. These interchange fees provide the income for the card issuer. Acquirer also pays scheme fees, which are dependent on volume processed. This is one of the reasons why there is a strong trend towards consolidation in the market.

Acquirers earn their money by marking up the interchange fees, or by charging a fixed rate (either an amount, which would be more typical for debit cards) or a percentage, which would be more typical for credit cards). In the latter case the estimate of the mix of cards and country of origin are important, as an incorrect estimate could mean that acquirer would lose money.

Acquiring Banks assume much of the risk in the credit card processing network because merchant accounts are a line of credit and not a holding account like a current account. In the event a merchant becomes insolvent, and suffers fraud or chargebacks, acquiring bank suffers the loss if the funds cannot be recovered either from the merchant or the customer. For this reason, most Acquiring Banks require any individual/entity wishing to accept credit cards to undergo a credit check and/or supply financial data before establishing a merchant account.

Card associations typically consider a participating merchant to be a risk if more than 1% of payments received result in a charge back. Visa and MasterCard levy fines against acquiring banks that retain merchants with high chargeback frequency. To defray the cost of any fines received, acquiring banks are inclined (but not required) to pass such fines on to the merchant.

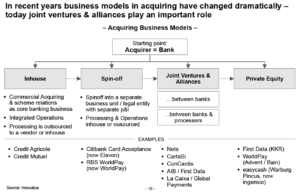

Leading European Acquirers are ConCardis, First Data, Credit Mutuel, Banque Populaire, BNP Paribas, Swedbank, Global Payments, Credit Agricole, Barclays and WorldPay. The main Irish and UK acquirers are:

1. Allied Irish Bank Merchant Services – a joint venture between AIB Bank and First Data Merchant Solutions

2. American Express

3. Bank of Ireland – offers its merchant service through EVO Payments

4. Barclays Merchant Service

5. Bank of Scotland – offers its merchant service through First Data Merchant Solutions

6. Clydesdale Bank – offers its merchant services through WorldPay

7. Elavon Merchant Services

8. HSBC – HSBC offers its merchant services through Global Payments

9. Lloyds Banking Group Merchant Services – partly owned by First Data Merchant Solutions

10. Ulster Bank/NatWest/RBS – offer their merchant services through WorldPay

11. Santander – Santander offers their merchant service through Elavon

12. WorldPay Business Services

13. Yorkshire Bank – offers its merchant services through WorldPay

Acquirer Licences

For an acquirer to be able to sign up merchants for their MasterCard and Visa transactions a license from the card schemes in the relevant country or region is required. Historically, for this to take place, an acquirer has needed to have a presence in each country concerned. This enabled a license from the card schemes to be obtained and with it the relevant settlement BINs (Bank Identification Numbers) against which transactions are cleared. These BINs are loaded onto acquiring platforms for this purpose.

This BIN is visible on your credit card: it is the first 6 digits. This is why you are allowed to store the first 6 digits of the card number; the BIN is really handy because it can help you tell what type of card it is and who issued it. To be able to do the latter, you will need BIN files. Unfortunately, there is no 100% accurate BIN file available anywhere; please talk to us if you require more information.

If the bank did not have a presence in a certain country, an alternative way of obtaining BINs is to form a partnership with a bank in the country or countries where the acquirer wishes to do business. For example, Streamline has such a relationship with ANZ, the result of which is that Streamline has ANZ BINs domiciled in Australia and New Zealand set up on Streamline.

For a merchant, this is relevant, because it can make a difference in the fees to be paid as will be explained below.

Global license

Airlines are the only industry that can avail of global acquiring.

Pan European license

Visa and Mastercard versions of Pan European covers different countries. A Pan-European license does not mean the acquirer can offer domestic rates in every European country.

Cross Border Acquiring

If a merchant operates in more than one European country they could have an MSA with one bank that enables them to accept cards in several countries as opposed to having an MSA with an acquirer in each country, this is known as cross border acquiring and the banks are known as cross-border acquirers.

Card Schemes have cross-border acquiring programs that enable these banks to offer merchants a single contract covering multiple European countries, as per Visa and MasterCard respective European countries.

The merchant avoids the complexity and expense of separate contracts in each country.

The benefits of cross-border acquiring are:

1. Streamline operations – This type of centralised acquiring means no need for separate terms of business, separate settlement periods and complicated behind-the-scenes reconciliation. It streamlines the merchant’s operations and saves administrative costs.

2. Benefit from increased choice – Merchant will have increased choice and commercial freedom to select an acquiring bank outside their domestic market. This could be particularly useful if acquiring bank has specialist services or expertise that you can’t find in your own market i.e Gaming.

A cross border licence does not necessarily mean the merchant can achieve domestic rates, acquirer must build domestic rate tables into their platform.

Example of Cross Border Acquiring – Avis.

Avis had an MSA with an acquirer in each country that they were present in. In approx. 2000 they moved to Barclays whose cross border acquiring services replaced the local acquirers.

Multicurrency

The term ‘multicurrency’ is applied to a merchant who accepts transactions in a currency or currencies other than the currency of the country that they are domiciled or registered in. Settlement to the merchant may also be in a currency other than their local currency. Settlement may be on a like-for-like basis (between the currencies which acquirer supports), e.g. euro transactions settled to the merchant in euro. Alternatively, settlement may be on a cross-currency basis, e.g. euro transactions settled in Sterling. With a cross-currency settlement, the acquirer generates additional revenue through the exchange rate used in the conversion process.

Another term that is used is ‘cross border’. This applies to a merchant whose transactions originate outside of the merchant’s country.

Multicurrency Acquisition

Multicurrency Acquisition means the processing and acquisition of transactions in multiple currencies.

Key sectors requiring a facility outside a single country are:

1. International Airlines – this is still the only trading sector where acquiring can be done on a global basis

2. Car Hire and Hotels – although worldwide businesses, unlike airlines, the card schemes still do not allow global acquisition.

Merchant Services Agreement

It is a contract that sets out the terms and conditions of an agreement between the Merchant and the acquirer. It is a standard contract for most SMEs but custom for corporate merchants. Sets out all terms of the contract for example

• Bonds

• Pricing

• Other Fees

• Card Types

• Currencies

• Commerce Type (e.g. MOTO, ECOM, etc.)

The MSA includes details on funds transfer (when) and settlement, either gross (full amount) or net settlement (minus the fees). Before an MSA is issued, an in-depth analysis is required by the acquirer. Because of the higher complexity and often higher risk, and MSA for a corporate client can take months, whereas for most SME’s it would be weeks. The acquirer needs to set its fees very accurately as it needs to be competitive but if set too low, the acquirer will lose money; and also take into account any risk they take on. If the risk is higher, fees are higher, a (large) bond may be required and settlement times might be longer.

Risk

Crucial to the maintaining of a positive balance over time is the limiting of reversal of funds; Rebates/Refunds voluntarily initiated by merchant and chargebacks forcibly initiated by the cardholder.

Chargebacks are the biggest risk to any acquirer as they could potentially be at risk for up to 6 months of transactions. Example:

• Merchant X comes out with a new product for €30

• During the first-month sales are over €100,000

• To build on momentum Merchant X decides to spend all their cash on a Marketing campaign

• Several days later they find out that the original product has a bug in it and needs to be replaced

• As they do not have the cash they simply apologise to the cardholders and say they won’t be able to honour the warranty that was included

• The cardholders call their banks and issue chargebacks

• Acquiring bank attempts to debit the merchant but there are insufficient funds

• Acquiring bank is liable

To offset risk, merchants are often asked to have a minimum balance in the account with the acquirer.

Fees

The majority of Merchants may not be aware of different price plans that are available as acquirers tend to ‘hide’ their ability to offer alternatives to basic pricing such as interchange plus as it reduces margins. Not all acquiring platforms can support more complex pricing models, many can support basic pricing only. Newer platforms can offer more flexible pricing.

The main pricing models available are:

Blended Rate; single Rate for both credit (2-5%)and debit Cards (€0.17-€0.30). It is the most basic and costly option for the Merchant MSC rates are priced for each product – credit & debit and split by card scheme. Acquirer builds their margin into the MSC rates and takes the risk based on pricing assumption. Any downgrades, merchant errors, etc. are absorbed by acquirer

Discount Pricing; known as 2-tier (CNP) or 3-tier (CP), based on 2 or 3 rates: Qualified, Mid-Qualified (CP) and Non-Qualified. Qualification depends on type (e.g. ECOM), region (e.g. domestic) and security measures implemented (3dsecure/AVS/CVN) and rates are higher for non-qualified transactions.

Premium Products; Acquirers price products based on the various card type and scheme fees for products that attract high interchange rates are passed onto the merchants. Examples include premium products, commercial cards, business cards etc.

Interchange Plus; cheapest option for merchants, generally only available to larger clients. It is transparent but complicated and not offered by all acquirers. It will take a lot of managing by acquirers. Actual interchange fees and assessments are passed at a cost to the merchant with acquirer applying a fixed mark up to each transaction and usually a per-transaction fee. E.g. 0.3% (30 basis points) + €0.10 per transaction. Interchange plus pricing passes the specific interchange rate determined by the acquirer along with scheme fees and acquirer margin. Some acquirers e.g. Lloyds Cardnet charge the scheme fees and margin as one fee rather than isolate the two categories

As well as the transaction fees many MSA will include additional fees; often Merchants may not know about these until it is too late and they receive additional charges.

• Monthly Minimum

• Exception charges

• Cardholder Service Fee/Maintenance Fee

• Annual/Quarterly Fee

• Early Termination Fee

• Batch/Settlement Fee

• Processing Cost, each Acquirer must maintain and develop secure connections to the other players in the transaction life cycle. The cost of this is factored into any MSA

• Scheme Fee, this is an assessment fee that the Merchant must pay to the Scheme network that processes the transaction. This is usually 0.0925% for Visa and 0.095% for MasterCard

• Chargeback Fee

In summary:

Interchange

Interchange is the fee paid between the issuing and acquiring banks every time a Visa/MC card is used. It should not be confused with the fees paid by merchants to their banks.

Following a transaction, the merchant’s bank pays a fee to the cardholder’s bank. This helps banks share the costs of issuing Visa/MC cards and the cost of signing up merchants to accept those cards.

Interchange enables cardholders, merchants and their banks to participate in the transaction process.

Interchange fees apply only to the purchase part of the transaction, not refund.

Interchange fees depend on many factors:

Then there are also qualifying factors, one of the most important is timeliness.

1. Timeliness checks is one of the most crucial factors for interchange qualification with any delays by the merchant or acquirer processor having an impact on the level

2. The number of days can vary within MCC e.g. Airline where up to 15 days is allowed between the transaction date and file submission date.

3. In the UK, the time period for submission is 3 business days rather than 4 business days like other markets and therefore it is important that acquirers submit files in accordance with the reduced time period

4. The time period is determined between the transaction data – authorisation or clearing date that is used to populate the correct field – and the clearing submission date

Another factor is errors. MasterCard tends to reject transactions, which will then have to be resubmitted. If the data is incorrect, Visa does not reject the interchange qualification record but will downgrade the transaction normally to the worse rate. Visa will provide details of why items have been downgraded and acquirer will need to alter their processing platform accordingly

Other factors are:

• The presence or absence of magnetic stripe data

• The submission of enhanced transaction data

• A merchant’s card turnover and transaction volume

As mentioned above, location is an important factor in determining the interchange fees:

Inter-regional Transaction

A transaction where the Issuer of the card used is located in a different Visa/MasterCard Region to that of the Merchant.

Intra-regional Transaction

A transaction where the Issuer of the card used is located in the same Region as that of the Merchant.

Domestic Transaction

A transaction where the Issuer of the card used is located in the same country as the Merchant.

Notes:

1. Not all countries offer domestic interchange i.e. Malta . Maltese merchants are charged Intra-regional rates in their own country. . Pan-european means can acquire non-uk domiciled entity. Does not mean they can offer domestic. Acquirer would have to add interchange rates to platform.

2. Spain – Spain have high domestic interchange rates. It is difficult for external acquirers to enter Spanish market due to bilateral agreement between Spanish acquirers and Spanish issuers. The high domestic interchange rates are prohibitive for acquirers who do not have an issuing arm in Spain. What acquirer loses in the deal the issuer gains, this is not a problem if FI has both acquiring presence and issuing presence in Spain. On a side note, domestic interchange rates are split by MCC.

3. In France, acquisition is directly linked to banking activities and therefore acquiring banks are competing for the main banking activities of the merchants, not simply their card or transaction processing business. In the UK acquirers are in direct competition with each other often on a purely acquiring basis.

4. In some countries the domestic Interchange may be higher than Intra rates.

5. Appropriate rates must be used in each region. i.e. intra rates cannot be used instead of domestic to achieve better rate in cases where intra is lower than domestic.

6. Visa and MasterCard publically display their interchange rates.

Interchange by country can be found on webpages referenced below.

- http://www.visaeurope.com/aboutvisa/overview/fees/interchangefeesbycountry.jsp

- http://www.visaeurope.com/aboutvisa/overview/fees/interchangefeelevels.jsp

- http://www.mastercard.com/us/company/en/whatwedo/interchange/Country.html

Based on the transaction types you process, you might be charged higher or lower fees.

Card Present: A Card Present (or Retail) transaction is one where the debit/credit card used is physically in the presence of the merchant. These types of transactions would normally be processed using a physical terminal supplied to the merchant by their acquiring bank, and would be accompanied by chip & pin technology. The merchant would usually be able to avail of a much lower per transaction rate from the bank as the risk associated with card present transactions would generally be perceived to be much lower than in other environments. A Payment Processor do not provide support for Card Present transactions. A merchant cannot process through Realex using a MID reserved for card present transactions

MOTO: Mail Order/Telephone Order transactions are a type of Card Not Present transaction. The card details are provided to the merchant via mail or by phone. A merchant may use a MOTO mid for processing transactions via the Online Terminal or the Virtual Terminal (or for their own, remotely integrated MOTO system) but may not use this for E-Commerce transactions. Rates for MOTO tend to be higher than card present, but lower than E-Comm.

E-Comm: E-Commerce transactions are another type of Card Not Present transaction. In this case, application is for E-Commerce transactions – where customers enter their own card details via a website, without the intervention of the merchant. E-Commerce transactions would generally be considered to be a high risk (relative to card present transactions) and so carry a high per transaction rate from acquiring bank. E-Comm mids can be used to process MOTO transactions – however, if the customer intends on processing a large volume of MOTO transactions, they may be better off applying for a separate MID (which may come with a better per transaction rate from the bank). Using tools to offset risk, such as 3DSecure, often means you can avail of reduced rates.

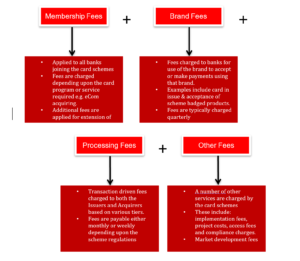

Scheme Fees

• Both card schemes use the fees generated to contribute towards local market activities designed to increase both usage and acceptance.

• Any item which is not processed by the scheme will not attract a processing fee but will attract a brand fee as defined by the card scheme.

• Depending upon the volume processed by acquirer, it is possible that an acquirer will move the between the tiers.

• Typically, acquirers will review their tiers on a quarterly basis as part of a pricing review to ensure the correct rate fees are being applied to merchant.

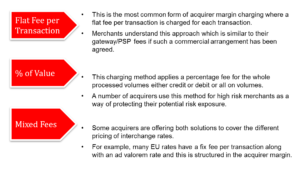

Acquirer Margin

All acquirer costs – risk, processing, staff, operating costs etc and profit margin need to be included in acquirer margin which can be charged either as a flat fee per transaction, a percentage of value or as a fixed monthly sum

• Based on an interchange plus plus pricing, acquirer needs to generate revenue in their margin to cover a variety of fees,

• These fees typically cover operational and processing services along with risk management and acquirer profit margin.

• There are a number of approaches that are taken with acquirer margin and is the only area where the merchant and acquirer will negotiated.

• Acquirers may change their approach for merchants that fall into high risk segments in order to protect their risk exposure.

• For example, an acquirer may want to charge a % rate for high risk merchants e.g. Airlines

• This could include a mixture of a flat fee per transaction along with retained funds on account