There are 3 basic ways of getting paid, cash, paper (cheques, postal orders, etc.) and digital (direct debit, bank transfer, card, or wallet).

The first two have the disadvantage of being physical, which means there is a high cost of processing involved, risk of losing payments, etc. Especially for CNP situations, these payment methods are not really fit for purpose.

We will focus on the last category. There are 6 subcategories. We are for now excluding virtual currencies such as BitCoin as this currency is currently more an investment product as a payment method.

Cards

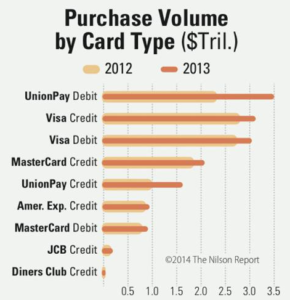

There are a handful of international card schemes: VISA, MasterCard, American Express, ChinaUnionPay, Diners/Discover, and JCB. Most of these schemes offer both Credit and Debit cards.

CUP is the biggest scheme but is hardly used outside China (although a lot of Chinese tourists are using it). JCB is mostly a Japanese card and Diners (incl. Discover) mostly US. American Express is also a card that is stronger in the USA than outside, but can be of interest because it is popular among business users/high spenders. In European markets, VISA and Master Card dominate.

Outside China, Visa dominates transaction volumes, due to their large market share of cards issued, accounting for $3.273 trillion dollars in spending in 2010. The next largest payment network is MasterCard, which processed $2.047 trillion dollars in 2010.

Spending on the Visa network accounted for 52.4% of global payment volume in 2010, compared to only 32.8% for MasterCard, and 11.2% at American Express. Discover placed a distant fourth place, accounting for 1.7% of spending.

American Express users spend over $7,714 per year, per card, which far exceeds spending on any other network. As a basis of comparison, Visa users spend only $1,725 per year, per card.

Sources:

- http://www.nerdwallet.com/blog/credit-card-data/credit-card-transaction-volume-statistics/

- http://www.moroku.com/the-war-in-crimea-will-weaken-visa-and-mastercards-market-share-even-further/

Local Card Schemes

These card schemes are usually debit only, and were designed with point-of-sale and ATM use in mind – that is, they were devised in a pre-internet world, and as a consequence may not be ideally suited for use in a card-not-present environment. SEPA legislation has meant that these local schemes are now co-branded with one of the international schemes, though transactions processed via the international schemes may not achieve the preferential interchange rates.

Some schemes have completely closed down (e.g. Laser in Ireland) and have typically been replaced by VISA and/or MasterCard Debit cards.

RTBT

A Real-Time Bank Transfer (RTBT) is an electronic transaction that transfers funds directly from the customer’s bank account to the merchants’ account in real-time. The customer is redirected to their bank’s website (or a third party website which facilitates such transactions) where they authenticate the transaction by entering their account details and some kind of transaction authorisation number (TAN), often generated from a secure device. In many cases the customer does not divulge their account details to the merchant, minimising the risk of those account details being compromised. As such, this kind of transaction is inherently secure and deemed to be a low risk of fraud. Additionally, many of these payment methods do no support “chargebacks”, which makes them very attractive to merchants. An RTBT may offer “multi-bank” support, allowing a merchant to accept transactions from customers of multiple different banks, or they may be “mono bank”, which means that specific payment methods must be implemented for customers of specific banks.

Wallets

An eWallet is essentially an account into which customers may deposit funds, and which can be used directly to purchase goods or services. In this sense, eWallets function in a similar fashion as Real-Time Bank Transfers, with real-time authorisation of the availability of funds. Like RTBT methods, the customer’s account details are not shared with the merchant, and so the details are seen to be inherently secure. This significantly reduces the risk of fraud.

The main advantage of eWallets over RTBTs is that RTBTs are often created for use in a specific market or country, whereas e-wallets are generally designed with international use in mind.

Direct Debits

A Direct Debit is a transaction in which the customer provides their personal account details to the merchant, and issues a mandate to the merchant to withdraw sufficient funds to cover the cost of that transaction. An electronic direct debit differs from a traditional direct debit in that no paper mandate needs to be signed – permission can be given by phone or over the internet. No verification of fund availability takes place, and because the account details are shared with the merchant, those details are open to compromise. As such, these payment methods are deemed to be at a high risk of returns due to lack of funds and are frequently exposed to fraud. Customers can chargeback transactions that have been attributed to them, and so merchants must take care to manage these risks. Despite these limitations, this method of payment is the preferred method of payment in the German market.

Offline Payment Methods

All payment methods discussed so far are initiated online: the customer provides details of a payment instrument to the merchant at the time of purchase, often with some real-time verification of the details and the availability of funds. Offline payment methods – where the customer fulfills the transaction after the order has been placed – are still popular across many markets, and in fact dominate in some key markets (for example, Germany and Poland). Offline payment methods fall into a number of categories:

• Traditional, paper-based payment methods are still widely used – examples include payment by invoice, payment by cheque, and payment by postal order.

• Cash on delivery is also a preferred payment method in many markets – in its simplest form, the customer pays cash to the driver who makes the delivery. However, more sophisticated versions exist – for example, in Germany, many postal and courier services will arrange a kind of “escrow” delivery service, where delivery will be held until the customer confirms that the payment has been completed.

• Offline credit transfers are also popular: the merchant provides the customer with their bank account details when the order is placed, usually accompanied by some kind of reference number for reconciliation. The customer then fulfills the order by transferring the funds directly to the merchant’s bank account either at a branch or via phone or online banking. The merchant will not ship the goods until the funds have been confirmed as received.